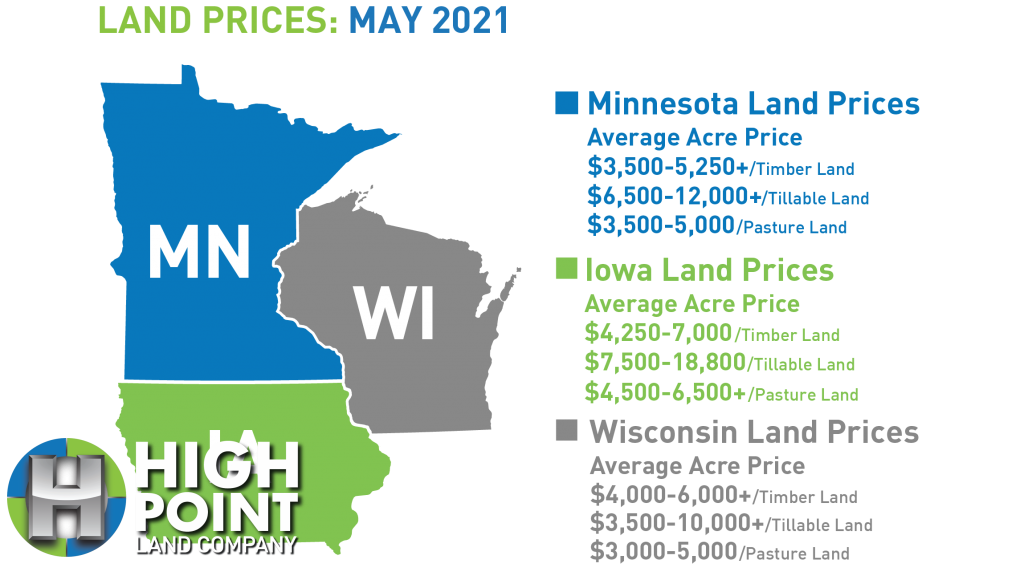

Land prices in the state of Iowa, Wisconsin and Minnesota for the month of May 2021 trended stable to higher month over month. Commodity prices and the stock market pulled back and have started to correct back, while interest rates have remained low and stable. Phrases like “welcome back” and “we are back on track” have covered the media nationally and locally the crop is in the ground ahead of 5 year average and much needed rains have been hitting the dry areas.

A few specific questions have arose over the course of the month from our 20 land agents, brokers, and appraisers. Is land a good investment now? Will land from an estate appraisal be higher if prices have climbed recently? What are walnuts worth in the Midwest? Is land in the Midwest going to go higher? Are rural building prices going to come down?

These questions are all great to be answered by one of our local agents because every market is different. For instance if you are building a home in Trempealeau County, WI on a dreamy parcel of whitetail hunting land; you have to factor in items like steep grades, access to utilities in the bluffs, county requirements, and more contractors in an area with many suppliers and a higher population. Compare this to building a home in central MN or Iowa in the flat tillable land, and you will have many different types of expenses and availability to contractors and suppliers.

The other question I will elaborate on is the future of land prices in the Midwest. It is a fact that we have more land coming on the market currently than this time last year. The market is absorbing land at a faster rate than it is coming on so if you have been considering selling a parcel over the last couple years that short term range appears to be a great opportunity to sell today with higher prices than where we were a year ago. That being said, prices can always go higher but they can also go down quickly if one of three items change.

Things that effect land prices in all categories are interest rates, commodity prices and weather. We have seen changes in all of these items over the last month alone paired with major supply shortages. These items quickly change big decisions like building a home, refinancing a property, or making a large equipment purchase.

Land prices over time have consistently gone up however like anything else they are cyclical along the way. Buying a property is usually a very long term decision, so as a buyer this is an excellent market to do so. If you are able to purchase a property today with a locked-in low interest rate and a long amortization schedule, it allows you to pay more for the property today than if rates were to increase resulting in a higher payment. This is why the current market is so good for both parties sellers and buyers alike.

If you are wanting to buy or sell land, now is a great time. The best way to start is either of these transitions like any large financial decision is to talk to a professional or even have an appraisal completed by one of our certified appraisers. Knowledge is power and if you are looking to do something in the near future, contact one of our agents. They love everything about land and are very knowledgeable on the topic. Thank you again for your business and referrals and have a great start to your summer.